Business Insurance Coverage in Denton, Texas

Since 2001, Quote Texas Insurance has been dedicated to serving businesses across Texas, including in Denton. We're experts in finding the best insurance solutions for businesses with maximum coverage. This ensures that you're protected from a variety of risks. We handle all the documentation and complexities involved in securing the right insurance policy for your business.

844-402-4464 get a quote NowWhy Business Insurance is Essential in Denton?

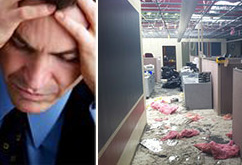

Denton has a diverse range of businesses, from small startups to large enterprises. No matter the size or industry, having comprehensive business insurance is crucial. Quote Texas Insurance brokers identify providers that protect your business in Denton from potential financial losses due to unforeseen events such as property damage, legal claims, employee injuries, and professional errors.

Our 8-Step Process Simplifies Business Insurance in Denton

At Quote Texas Insurance, we understand that each business is unique. That's why we offer tailored insurance solutions that meet the specific needs of your business in Denton. Our custom 8-step process includes:

- Extensive Carrier Search: We search through 65 top-rated insurance carriers to find the best fit for your business needs.

- Direct Underwriter Communication: We speak directly with underwriters for the most appropriate coverages are selected for you.

- Competitive Pricing: Using our insider knowledge, we negotiate with insurers to secure the best pricing available.

- Custom Coverage: We eliminate any carriers that do not meet your specific coverage needs and options.

- Quote Comparison: We compare quotes for rates and coverages from only the best remaining carriers.

- Client Advocacy: We advocate for you by listing recommendations and discussing all your quote options.

- Comprehensive Evaluation: We rate each company based on Ease of Use, Financial Rating, Value, Coverage, and Cost.

- Convenient Policy Completion: We never require an office visit; completing your policy over the phone and online is quick and easy.

Comprehensive Coverage Options in Denton

We provide access to a wide range of business insurance options to ensure your Denton business is fully protected. These include:

- General Liability Insurance: Covers third-party claims of bodily injury, property damage, and personal injury.

- Commercial Property Insurance: Protects your business's physical assets, such as buildings, equipment, and inventory.

- Workers Compensation Insurance: Provides medical and wage benefits to employees injured on the job.

- Professional Liability Insurance: Covers legal costs associated with claims of negligence or inadequate work.

General Liability Insurance

General liability insurance is a fundamental coverage for businesses of all sizes, offering protection against a variety of potential risks. This insurance covers third-party claims of bodily injury, property damage, and personal injury that may occur during the normal operations of your business.

For instance, if a customer slips and falls at your premises or if your business accidentally damages a client's property, general liability insurance can help cover the associated legal fees and medical expenses.

Protect Your Assets with Commercial Property Insurance

Commercial property insurance safeguards your business's physical assets, including buildings, equipment, and inventory. Denton businesses face various risks, such as fire, theft, and natural disasters.

This insurance covers the costs of repairing or replacing damaged property, ensuring your business can quickly recover and continue operations. Additionally, it includes business interruption insurance, which replaces lost income if your business is temporarily unable to operate due to covered property damage.

Ensure Employee Safety with Worker's Compensation Insurance

Workers' compensation insurance is essential for any business with employees. It provides medical care and wage replacement benefits to employees injured on the job.

In Denton, businesses are required to carry workers' compensation insurance, making it a critical component of your insurance portfolio. This coverage also protects your business from potential lawsuits filed by injured employees, covering legal fees and settlements.

Professional Liability Insurance for Service-Based Businesses

Professional liability insurance, also known as errors and omissions (E&O) insurance, protects businesses that provide professional services or advice. It covers legal costs associated with claims of negligence, misrepresentation, or inadequate work.

In Denton, where industries such as consulting, technology, and healthcare thrive, professional liability insurance is essential to protect your business from costly legal battles.

Why Choose Us For Your Coverage in Denton?

Choosing Quote Texas Insurance means choosing a partner dedicated to finding the best insurance solutions for your business. Here's why you should work with us:

- Personalized service: We tailor our services to meet the specific needs of your business.

- Wide network: We shop multiple top-tier insurance companies to find the best coverage and rates.

- Expertise: With over two decades of experience and a proven track record, we know the ins and outs of the insurance market.

- Comprehensive process: Our custom 8-step process ensures thorough analysis and optimal solutions.

- Client focused: We represent you, not the carriers, ensuring your interests are always prioritized.

Business Owner’s Policy (BOP) Solutions in Denton

A Business Owner’s Policy (BOP) is an excellent option for many small and medium-sized businesses in Denton. A BOP combines general liability insurance and commercial property insurance into a single, convenient policy.

This comprehensive coverage is ideal for businesses that want to protect their physical assets and safeguard against liability risks.

Supporting a Variety of Industries

At Quote Texas Insurance, we understand that different industries have different insurance needs. We have successfully served Denton businesses in various sectors, including:

- Retail Shops

- Restaurants and Food Services

- Construction and Contractors

- Healthcare Providers

- Professional Services

Rely on Us For Business Coverage You Trust in Denton

Protecting your business is our top priority. Schedule a consultation with Quote Texas Insurance today to discuss your insurance needs. Our experienced specialists will guide you through the process. We are a licensed and experienced company. Stay worry-free and let Quote Texas address all of your commercial insurance concerns in Denton. Call or get a quote online today.